Savix is a decentralized financial product

- Dapatkan link

- X

- Aplikasi Lainnya

Cryptocurrency has become one of the favorite investment instruments in the world today. Not only that, crypto currencies are also rapidly developing into alternatives to cashless transactions, such as remittances and cross-border transactions.

With Savix, a virtual currency is now available for the first time, which makes it possible to benefit from staking rewards while keeping the tokens open and liquid, available for free to use on any DeFi product at the same time.

The Embedded Staking (PES) * protocol used here is deeply embedded in the base currency code and requires no explicit user control or triggering. All wallets holding Savix tokens automatically and permanently take part in the betting process.

All contracts and tools necessary for implementation are fully developed and in the final step of internal audit. Currently the contract is running smoothly on the Rinkeby testnet. We plan to switch to mainnet in early December 2020.

The Savix project aims to make decentralized financial products available to non-tech-savvy users. Savix Tokens allow gas-free automatic staking rewards.

We believe that Savix is the best guarantee for decentralized finance because it is

Multi Beneficiaries

Since the Embedded Staking Protocol (see next paragraph) allows full availability of token use in other DeFi products, rewards can be "doubled" using Savix. In this way, staking rewards work like an additional layer of passive income. The upcoming “Trinary” liquidity incentive program (see 7) will offer Savix holders a different additional income stream.Comfortable

Savix bets are embedded in the standard ERC20 transfer function and are fully automatic and 100% passive with no user decision or interaction necessary to receive the prize.Flexible

Savix is compatible with Ethereum based DeFi projects. Savix Coins can be used like all standard ERC20 tokens to collect, lend, generate farms, mine and so on, all of this while continuing to generate additional stake tokens to holders.Fair

The embedded Savix protocol stakes evenly adjusts all balances according to the embedded offer development curve. No preference of any kind is given to any particular holder. All wallets are treated the same way, regardless of balance, transaction volume or other parameters.Transparent

Open source Savix. All program code and contracts are available via Github and can be checked and tested by anyone. Due to the implementation of a single contract, manipulation of the contract logic or the maximum supply is not possible, there is no additional minting of coins. Bet prizes are fully transparent and predictable.Stable

With Savix, no reward release event at the end of the lock-up period can result in a cyclic dump. Except for market reasons, selling Savix has never been easier or more profitable at any given point in time, creating less volatility.Independent

With Savix you remain independent because tokens are always liquid while earning rewards (without locks) and can be freely transferred or invested in other DeFi products.

Vision

Our main goal is to enable users to benefit as much as possible from the new investment opportunities created by decentralized finance with the least amount of constraints possible. Therefore, users combine multiple income streams while maintaining full flexibility of token use. The betting mechanism built into the Savix protocol works without requiring any user action. Users do not need to lock their tokens and do not need to claim their rewards as the staking process is fully automated.

What is embedded staking protocol?

In order to realize the staking features mentioned above, a staking mechanic has been built into the ERC20 protocol. The algorithm works by inflating the total token supply on a regular basis according to the mathematical logic implemented into the smart contract. The account balance is determined by the respective share of the total supply thus guaranteeing a non-dilutive token allocation. In this way the relative betting advantage is and remains the same for all accounts regardless of user-related size and parameters such as bet duration, bet pool selection etc.

The mathematical logic that forms the basis of the Savix embedded staking protocol follows the following characteristics:

- Transparent supply calculations can be predicted by investors

- Stability of calculations against user behavior and network effects

- Effectiveness of calculations regarding computing power and transaction costs

The development curve of Savix's offering is the best combination of these characteristics. The gradual development of supply is determined by a straight sequence (gradient) that determines the interest rate at a particular point in time. The starting and ending points (corner points) of this straight line determine the global shape of the supply curve. Each straight line is defined by the equation:

F (x) = (Xt - X1) * [(Y1 - Y1) / (X2 - X1)]

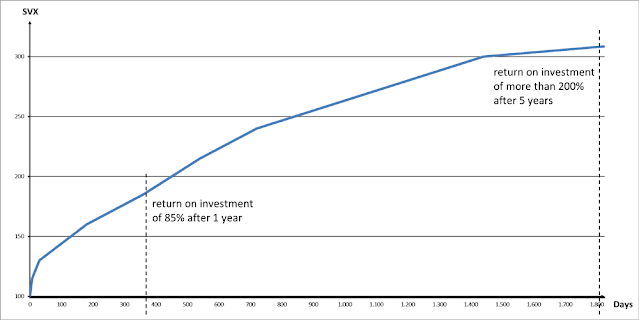

The following diagram shows the temporal progression of the initial 100 SVX investment.

The absolute transparency of the development of temporal reward staking leads to the fact that no specific stimulus for token dumping appears at any given moment, whereas common staking technologies require frequent token locking combined with a certain minimum lock duration. After the lockdown period, the possibilities for selling large quantities of tokens increased rapidly. The Savix staking automatism does not stimulate such dumping situations.

Token Technology

Since using DeFi applications (such as participating in the Uniswap liquidity pool) is the main usage scenario for the Savix token, implementation as an ERC-20 token is required. Non-exchangeable tokens can play an important role in future concepts and the ERC-721 or ERC-1155 standard can also be used for future development.

However, the Savix token itself will not be touched by all future developments. It will be designed as a separate contract that interacts with the original Savix contract. The immutability of implementing the Savix contract is guaranteed and is an important part of the Savix trust building concept:

- Absolute transparency and contract code obligations due to implementation of a single contract (no unexpected changes can be made to staking parameters).

- Absolute transparency and obligation of staking rewards due to non-dilutive staking rewards determined by an unchangeable supply map (future interest rates can be predicted with precision)

- Absolute accuracy and transparency of the total circulating supply. The circulating supply of tokens is always identical to the total token supply, no token is being held in any way. The only exception is the unsold tokens during the pre-sale (6 months lockout time)

What do we plan to do in the future?

We intend to integrate as many DeFi investment opportunities as possible into a user-friendly Dapp for all Savix users. In our view, taking advantage of new ways of income with decentralized finance should not only be reserved for highly tech-savvy users.

Savix "Trinary" will be the first element of this Dapp to demonstrate the power of the ERC20 embedded in staking:

Users receive ETH to provide liquidity on automated market creation (AMM) platforms such as Uniswap. The more liquidity you provide, and the longer it is, the bigger share of the ETH pool you receive.

Trinary details:

Uniswap Rewards

There is a 0.3% fee to exchange tokens at Uniswap. This fee is shared by the liquidity provider in proportion to its contribution to the liquidity reserve. It serves as a payment to all liquidity providers in proportion to their share of the pool.

Prize bets

In addition, you will get Savix staking rewards from the embedded staking protocol while your tokens are used as liquidity.

Trinary awards

Whenever liquidity is deposited into a uniswap pool, a special token known as a liquidity token is printed to the address of the provider, in proportion to how much liquidity they contribute to the pool. This token is a representation of the contribution of the liquidity provider to a pool. With the Savix “Trinary”, you can store your Savix liquidity tokens for up to 6 months to receive another layer of rewards: ETH from our Ecosystem Fund. We expect a return of 7% to 15% of the initial investment paid directly in ETH during the first 6 months.

Roadmap

- For December 2020, a public token sale and the start of the UNiswap liquidity pool are planned.

- Soon thereafter development of the Savix trinary Dapp will begin by establishing partnerships with other DeFi providers.

- Approximately March 2021 the first Alpha version of Trinary will be available.

Summary

In short the features of Savix:

- Staking installed protocol

- Compatible with any DeFi project

- Fully automatic - 100% passive

- Real time prizes

- Multiple layers of passive income

- Transparent work mechanism

- Stable against manipulation

- A working product is ready to use

Using Savix, investors can receive triple the rewards:

- ETH and Savix from Uniswap fees

- Savix from ERC20 embedded staking protocol

- ETH from Savix "Trinary" Pool

This triple revenue stream is possible via Savix's unique betting protocol alone!

Learn more about this project:

Website: https://savix.org/

Telegram: https://t.me/savix_org

Twitter: https://twitter.com/savix_org

Whitepaper: https://savix.org/wp-content/uploads/2020/11/SAVIX_Whitepaper.pdf

For documents and media see: https://savix.org/media

Media: https://anatol69.medium.com/

Github: https://github.com/SavixOrg

https://bitcointalk.org/index.php?action=profile;u=2498921

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar