UnitedCrowd is a digital financing tool tailored to the needs of businesses around the world

What is UnitedCrowd?

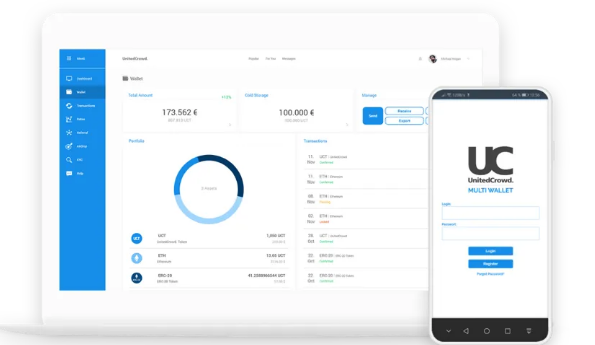

UnitedCrowd is a platform that allows businesses to acquire investors around the world, attract customers and expand the business community. The solutions offered by UnitedCrowd are digital financing tools tailored to business needs. UnitedCrowd will assist businesses with in-depth expert knowledge, smooth processes and state-of-the-art technology. So businesses just need to focus on developing their platform and UnitedCrowd will take care of the rest. UnitedCrowd allows businesses to tag their business. UnitedCrowd releases digital financial products that can be tailored to business needs. UnitedCrowd tokenization serves many digital financial products, ranging from securities, investments, etc., as well as physical assets and new financing models. This is the best choice of digital direct funding for businesses. The UnitedCrowd platform is a free all-in-one tool that gives you access to the world of digital investments. There you will find exclusive investment options, you can purchase tokens, receive bonus tokens, build a digital portfolio and easily manage them. With the app version even on the go.

After the free registration, there are numerous tools available for this, which you can access via an intuitive dashboard:

- Compliance module: Simple and secure processing of KYC and AML.

- Reward module: Earn bonus tokens with simple activities.

- Multi-wallet: storage, trading and transfer of your digital assets.

- Payment system: Secure payment system without detours in Fiat and crypto.

- Statistics: overview of portfolio and transactions.

- Security: Maximum security through 2-factor authentication.

UnitedCrowd is an official platform registered in Germany, so you don’t need to worry about wasting time using this service, and here you will get maximum security when transacting. UnitedCrowd only works with qualified and trusted investors and will help you find the right investors, in fact, taking all the work to fund your project.

Problems companies and investors.

- No access to corporate finance.

Many companies, especially start -ups and medium — sized companies (SMEs) are denied access to capital. When it comes to raising funds, a majority depends on a small number of powerful intermediaries, such as banks.

- Lack of interaction.

Traditional funding mechanisms offer insufficient opportunities to build a community and real interaction between companies and their investors. The potential offered by networking and engagement with investors for business success remains untapped.

- High costs and intermediaries.

Corporate financing is associated with the commissioning of numerous intermediaries and mostly is cost — intensive. Investors rely on fee — based services of custodians.

- Hurdles of a Tokenization.

Conducting a Tokenization requires sound specialist knowledge. The vast majority of companies cannot handle this task alone.

- Loss of control.

When financing via private equity, SMEs are usually forced to give up significant shares and thus decision — making power in their company.

- No fractional ownership.

With traditional options, intangible assets can hardly be converted into fractional ownership. Only few have access to international markets where intangible assets can be made tradable.

- Lack of transparency

Corporate finance requires company valuations. These valuations are particularly non — transparent and subjective when it comes to financing via private equity and crowdfunding mechanisms. The lack of transparency endangers companies and investors alike.

- Lack of access to investments.

Private investors are often denied access to profitable investment opportunities and investments, especially in start — ups and SMEs. Lucrative capital investments are mostly reserved for institutional investors.

- High work — load and time exposure.

Raising capital is labour intensive and time consuming. Large parts of a company’s capacity are often tied up in the long term to meet the financing needs.

- Lack of investor protection.

The current regulations on the crypto market do not achieve adequate investor protection. Quality — tested investment opportunities are rare. With every investment there is a risk of becoming a victim of fraud.

Solution UnitedCrowd.

UnitedCrowd connects companies and investors and solves problems like the one above. We developed UnitedCrowd in response to the aforesaid problems. With a regulatory — compliant and responsible tokenization, the business model offers a solution for financing difficulties of companies and needs of investors alike. For the implementation of our solution a technical solution was developed, which is based on four dynamically connected pillars: Tokenization Platform, Tokenization Framework, Multi Wallet and the Community Token. To solve the difficulties of many companies in implementing a compliant and successful Tokenization , these technical components are supplemented by adaptive services. An integral part of our solution is the UnitedCrowd Community, a network of investors to which we offer active participation and access to exclusive investment opportunities.

What is tokenization?

Tokenization is an automated solution to digitizing value, including all rights and obligations contained in these values, by issuing tokens that are registered in the distributed ledger technology (DLT) infrastructure. The resulting token represents a digital form of these values, which can be sent via the blockchain. UnitedCrowd issues digital financial products, for example corporate finance. Our range of tokenization services includes existing financial products such as securities, investments, etc., as well as new physical assets and financing models.

What can be tokenized?

- Asset Token (financial assets)

Both liquid and illiquid assets can be represented as tokenized securities by Asset Token. In this way, they can be converted into digital and proportionate fractional ownership (partnership) and made accessible to an international market. The spectrum encompasses everything from cash, cash equivalents, savings accounts, real estate, precious metals or art objects to intangible assets such as patents, copyrights or trademark rights.

- Equity token (shares)

Equity tokens can represent shares in a company and voting rights, as well as shares in funds.

- Debt Token (claiming rights)

Tokens represent a debt claim for repayment of the invested amount with or without interest. The range includes forms of bonds, loans and bonds.

- Utility token (services and usage rights)

Utility tokens represent usage rights and can be used, for example, to grant access to a network as a community token or to receive the goods or services offered by the issuer of the token.

Advantages of tokenization through UnitedCrowd.

Tokenization has a couple of central focuses, which we will show underneath:

- The entire day, consistently showcases

- Fractional belonging

- Compliance

- Reduction of costs and center individuals

- Peer-to-peer transmission

- Fast planning

- Programmability

- New money related things

Features of the Platform

UnitedCrowd іѕ а full-service partner fоr digital corporate funds. UnitedCrowd рrоvіdеѕ а variety оf tokenization products, ranging frоm securities, investments, etc., аѕ wеll аѕ physical assets аnd nеw financing models. Whісh іѕ perfect fоr clients whо wаnt tо localize thеіr business аnd grow thеіr business. Fоllоwіng аrе thе features оf UnitedCrowd;

- Web-based platform solution: It allоwѕ clients tо manage thеіr campaigns vіа browser оr app. Thе dashboard wіll display thеіr investments аnd management statistics.

- Digital contracts: Smart contracts thаt provide thе highest level оf security аnd transparency tо thе user.

- Document management: All marketing materials, legal documents, instructions, аnd guidelines, wіll bе рrоvіdеd bу UnitedCrowd tо investors.

- Individualizable layout: Allоwѕ clients tо request front-end layouts ассоrdіng tо thеіr ideas аnd designs. On thе backend, widgets offer customizable statistics.

- Professional hosting: UnitedCrowd рrоvіdеѕ hosting services thаt wіll host thе client’s online platform.

- Secure sales transaction: Token sale transactions wіll bе secured uѕіng thе escrow system. Investors wіll bе checked wіth thе KYC аnd AML systems.

Which services does UnitedCrowd offer for companies?

With UnitedCrowd, you get all the services you need for digital capital raising or asset mapping from a single source. In addition to technical development, our services also include advice, the creation of professional websites, legal documents, white papers and brochures, the control of optimized marketing & PR campaigns as well as the handling of KYC, AML and payment transactions. We offer both utility, security and hybrid token concepts that we adapt to the requirements and goals of your company. We communicate all tokensales that we implement for our clients via our platform on our investor network, the UnitedCrowd Community. All services are offered in packages that can be combined as well as booked individually and to give you maximum flexibility.

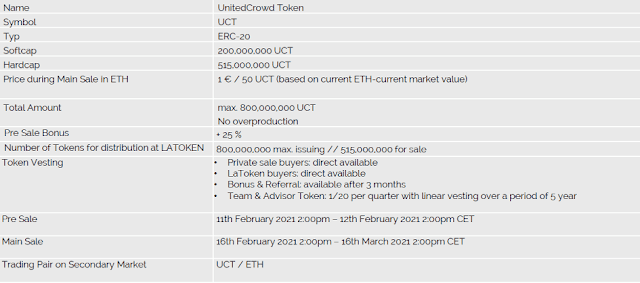

UnitedCrowd Token Information — UCT

UnitedCrowd launched a token with the name “UCT Token”, this token will serve as a utility token. By holding UCT tokens, you support UnitedCrowd’s vision of being the “First Tokenization Accelerator”. With the UCT purchase, investors are not only supporting UnitedCrowd but also high-quality start-ups that UnitedCrowd will be tokenized for. Investing in UCT means crowdfunding a promising Crowdsales portfolio. A maximum of 800 Million UCT will be generated on Ethereum — Blockchain (ERC-20 Token).

Roadmap

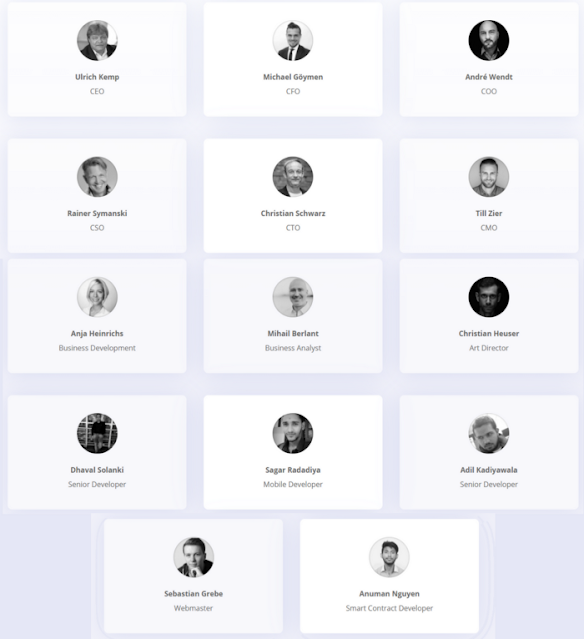

Team UnitedCrowd.

UnitedCrowd project partner.

For more information, you can see it below:

Website : https://unitedcrowd.com/

Facebook : https://www.facebook.com/UnitedCrowd/

Twitter : https://twitter.com/unitedcrowd_com

Telegram : https://t.me/UnitedCrowd

Medium : https://medium.com/@unitedcrowd

Whitepaper: https://www.dropbox.com/sh/kk5jokjr1y1jtdm/AAD_Yvj2dhA442_S3sHqHrwTa?dl=0&preview=UnitedCrowd_Whitepaper_en.pdf

Bounty Thread : https://bitcointalk.org/index.php?topic=5311966.0

My profil:

Komentar

Posting Komentar